I’ve been in business a long time now, from retail to service to ag, and I’ve learned some things about wrapping up one year and getting ready for the next. Some of it I learned the hard way! Whether you run your business on paper, desktop software, mobile or cloud services, there are common tasks […]

I’ve been in business a long time now, from retail to service to ag, and I’ve learned some things about wrapping up one year and getting ready for the next. Some of it I learned the hard way!

Whether you run your business on paper, desktop software, mobile or cloud services, there are common tasks that need doing at year-end. Here’s your checklist.

Time for those must-do end-of-year tasks! Photo by mavoimages via Depositphotos.

Must do Jan 1

These are the ones you can’t easily do later, so you don’t want to put them off.

The good news: these are the easy ones.

Count your inventory.

If you sell or make products, take an inventory of all products and raw materials on hand at the turn of the year. You need the value of what it cost you. If you use a point-of-sale (POS) system, write down the end of year inventory total on January 1.

Why you have to write it down: Most POS systems only keep a running (current) inventory total. If you forget to write it down now, you’ll have to figure backwards from all purchases and sales since Jan 1. Trust me, this is not a fun job.

When I managed a liquor store, we took advantage of being closed on New Year’s Day to do a full count of our inventory and correct our POS records. It didn’t take long with one person counting, and one running the laptop to make corrections.

Record end of year mileage.

If you use your vehicle for business, write down your mileage at the end of the year. This provides an important baseline for your mileage records all year long. I always put this on my online calendar so I can find it easily.

Get these done during January

These are the tasks that need to be done soon, but don’t have to happen on January 1. But don’t let it slide, or you’ll pay for it with rushed days during tax filing season.

How to get this done: Right now, commit time on each Friday during January to work through the checklist until you’re all finished.

1. Financial Data

Backup accounting data in two formats.

Yes, this applies whether you use paper records, software, app or a cloud service. Every data service is subject to being interrupted at the worst possible time or even closing down with no warning.

Hot tip: Do an export of the data in your accounting system’s backup format and then also in CSV. So if you use Quickbooks, let it back up in the special .qbw format, then do another backup in CSV.

Run accounting reports in PDF.

Run year-end financial reports as PDFs. If you need this data in a few years from now, it will be easy to look at a PDF report that shows the answer in an easy-to-read format. If all you have is a CSV, you’ll get to re-import it in whatever system you’re using then, reformat and clean up the data, then run a report to see the answer.

This also gives you insurance against changes in your accounting service. I can’t even tell you how many different accounting services and programs I’ve used over the years!

Here are the key year-end reports to run:

- Profit and Loss, Jan 1 – Dec 31 (PDF)

- Balance Sheet, dated Jan 1 and another dated Dec 31 (PDF)

- Detail of every transaction, Jan 1 – Dec 31 (PDF, this will be long)

- Export all data as a backup (standard and CSV)

Run payroll reports.

Save these as PDFs as well. Payroll reports are critical tax documents. Do not lose these.

- Payroll details for each employee, Jan 1 – Dec 31 (PDF)

- Payroll tax filings, Jan 1 – Dec 31 (PDF)

- Export all data as a backup (standard and CSV)

Download online banking and payment transactions.

Make sure you have downloaded a PDF report of all transactions for the year. Your bank may restrict how long statements are available, so download all of last year’s bank statements now.

- Banking statements

- Online billpay details

- All transactions in CSV

It’s easy to overlook payments received via online services, so dig deep. Did you accept payments anywhere? Get a backup of that data.

- PayPal

- Square

- Stripe

- Venmo

- Zelle

- Cash App

- Any online transaction processor

Download copies of bills.

We all do business in so many places that it’s tough to keep up. Since bank statements alone aren’t enough to satisfy the IRS, you’ll want PDFs of these and any other online financial data. Make a list of these so you can refer back to it next year.

- Utility bills

- Credit card statements

- Insurance bills

- Supplier invoices

- Tax filings

Update employee and contractor data.

Do you have a current mailing address for every employee and former employee you paid during this year? You’ll need that when you issue your W2 forms.

Many small businesses rely on independent contractors who may or may not live nearby. For US small businesses, you’ll need to send 1099 forms to each contractor you paid more than a few hundred during the year. (Check with a tax pro for the details.) One thing you can do right now is make sure you have updated data on your contractors.

- Ask employees and former employees for any updates to their W-4 form or mailing address

- Ask independent contractors for any updates to their W-9 form

If you don’t have those W-4 or W-9 forms, now is the time to get them.

2. Backup your data

Download cloud files.

Your small business probably relies on cloud solutions for collaboration, invoicing, email, and other key functions. Review your cloud services and download copies of all critical files and data. Make a list of your current cloud services to make this task easier again next year.

- Password management (1Password, Bitwarden, etc.)

- Contacts, customer lists

- Google Drive/Docs

- Microsoft OneDrive/Office 365

- iCloud

- Dropbox

- Any cloud service with important data

Download data from business platforms.

If you use an online business platform like Shopify, Etsy, Podia, or Squarespace, download all your records and contacts.

Do you have an email newsletter? Download your list of email addresses and all detail as a backup.

If you use social media for your business, back up contacts, critical messages, and business transactions from Facebook Business Suite, Instagram, or other platforms.

These platforms are always changing and vary widely, so use your judgment about what’s critical for your business. If figuring out all your platforms and data turns into a big job this year, make yourself a checklist so it’s easier next January.

Run off your calendar.

Your business calendar documents your travel, meetings and more related to your work. It’s a vital business record. If you use a paper planner, set a consistent and secure location to keep the old calendars available for at least five years. If you use an online calendar:

- Save a PDF of your entire year’s calendar

Then check the formatting, to be sure it’s readable. You probably have to break it down by month or by week, or even by day, in order to make all the detail visible.

This one report has saved me so much trouble over the years. Always save your calendar.

Back up your phone.

Your phone holds critical business data: contacts, photos, and important messages. For most businesses, it’s probably enough to back up iPhones to iCloud and Android phones to Google Drive. Make sure that backup is current and includes your photos, contacts, and any critical business messages.

Backup your files: don’t skip this

You’ve just collected a lot of critical financial data for your business. Don’t risk losing those files.

- Assemble all these files into a single folder dated with the year

- Send a copy to cloud backup such as Google Drive, OneDrive, or Dropbox

- Keep a copy on a USB thumb drive or an external hard drive separate from your computer

That last step – the physical backup – is more important than ever. We all rely on cloud services now, but having your own copy means you’re protected if anything happens to those services or your computer. That’s another lesson I’ve learned the hard way!

Subscribe to SmallBizSurvival.com

Recommended Story For You :

Crypto secrets livestream bootcamp

Remix Your Business.Transform Your Life.

Launching Your Woodworking Business From Home... With Minimal Capital

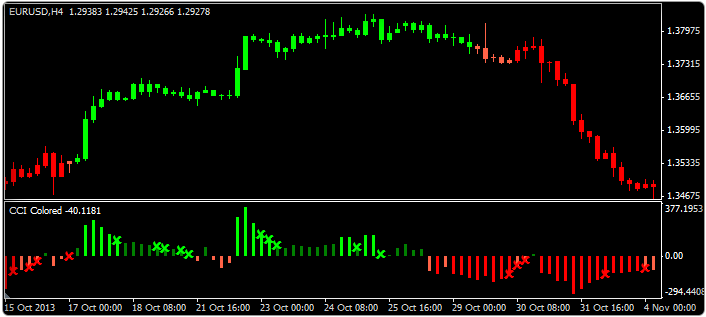

100% rule based Forex system

Trusted Forex Signals Your Journey Starts Here

Adsense Pirate- from $8 a Day to $800+ A Month

Autotrading Made Easy

Why create project documents from scratch when you have

Want to become a professional trader and earn 10x more profits?